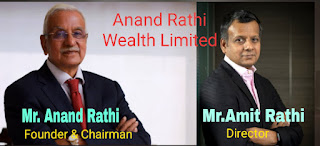

Anand Rathi Wealth Limited

Anand Rathi Wealth Limited’s initial public offering to open on December 2, 2021

· Price Band of ₹530 – ₹550 per equity share bearing face value of ₹5 each (“Equity Shares”). The Offer includes a discount of ₹ 25 to Eligible Employees bidding in the Employee Reservation Portion.

· Bid/Offer Opening Date – Thursday, December 2, 2021 and Bid/Offer Closing Date – Monday, December 6, 2021.

· Minimum Bid Lot is 27 Equity Shares and in multiples of 27 Equity Shares thereafter.

· The Floor Price is 106 times the face value of the Equity Share and the Cap Price is 110 times the face value of the Equity Share.

Mumbai, November 30, 2021: Anand Rathi Wealth Limited, one of the leading non-bank wealth solutions firms in India is proposing to open its initial public offering of Equity Shares (the “Offer”) on Thursday, December 2, 2021 which will close on Monday, December 6, 2021. The price band for the Offer has been determined at ₹ 530 – ₹550 per Equity Share of face value of ₹ 5 each.

The initial public offering fully consists of an offer for sale of up to 1,20,00,000 Equity Shares of face value of ₹ 5 each by Anand Rathi Financial Services Limited, Anand Rathi, Pradeep Gupta, Amit Rathi, Priti Gupta, Supriya Rathi, Rawal Family Trust acting through Rakesh Rawal, Jugal Mantri, and Feroze Azeez (the “ Selling Shareholders”).

The Company and the Selling Shareholders have, in consultation with the Book Running Lead Managers, considered participation by Anchor Investors in accordance with the SEBI ICDR Regulations, whose participation shall be one Working Day prior to the Bid/Offer Opening Date, i.e. on Wednesday, December 01, 2021. The Offer is being made in terms of Rule 19(2)(b) of the Securities Contracts (Regulation) Rules, 1957, as amended, read with Regulation 31 of the SEBI ICDR Regulations. The Offer is being made through the Book Building Process, in compliance with Regulation 6(1) of the SEBI ICDR Regulations, wherein not more than 50% of the Net Offer shall be available for allocation to Qualified Institutional Buyers, not less than 15% of the Net Offer shall be available for allocation to Non-Institutional Investors and not less than 35% of the Net Offer shall be available for allocation to Retail Individual Investors.

The Company commenced activities in Fiscal 2002 and is AMFI registered mutual fund distributor and has evolved into providing well researched solutions to its clients through a mix of wealth solutions, financial product distribution and technology solutions to a wide spectrum of clientele. As per CARE Advisory Research, the Company has been ranked amongst one of the top three non-bank mutual fund distributors in India by gross commission earned in Fiscal 2021, 2020 and 2019.

Since March 31, 2019 till August 31, 2021, the Company’s Asset Under Management (AUM) has grown at a CAGR of 22.74% to ₹ 302.09 billion. As on August 31, 2021 the Company’s flagship Private Wealth vertical catered to 6,564 active client families across the country. Over 50% of its clientele has been associated with Anand Rathi Wealth Limited for more than 3 years. The Company has paid dividend at the rate of 50% in Fiscal 2021 and had issued bonus shares in August 2016 and July 2021.

In addition to private wealth vertical, Company has two new age technology led business verticals i.e. Digital Wealth (DWM) and Omni Financial Advisors (OFA). DWM vertical is a fin-tech extension of the Company’s proposition for the mass affluent segment with wealth solution delivered through a combination of human interface empowered with technology and the OFA vertical is a strategic extension for capturing wealth management landscape to service clients through independent financial advisors by using a technology platform.

India has the key ingredients of a high growth wealth management market and is on the move to become the fourth largest private wealth market globally by 2028. According to Karvy India Wealth Report 2020, by Fiscal 2025, Financial Assets and Physical assets are expected to reach ₹512 trillion and ₹299 trillion at a CAGR of 14.27% and 8.14%, respectively. (Source: CART Industry Report)

Equirus Capital Private Limited, BNP Paribas, IIFL Securities Limited and Anand Rathi Advisors Limited are the book running lead managers to the Offer (“BRLMs”).

All capitalized terms used herein and not specifically defined shall have the same meaning as ascribed to them in the red herring prospectus dated November 26, 2021 (“RHP”) filed with the Registrar of Companies, Maharashtra at Mumbai (“RoC”).

RHP Link: https://www.sebi.gov.in/

Comments

Post a Comment