November 2022 auto sales preview: Volume growth to continue in CVs, PVs, and 2-Wheelers

November 2022 auto sales preview: Volume growth to continue in CVs, PVs, and 2-Wheelers

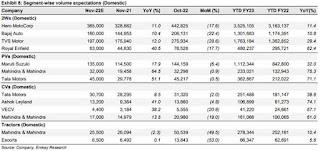

Mumbai, November 25: Emkay Global Financial Services conducted a channel check to gauge the volumes’ estimate for the month of November. The channel checks indicate higher volumes for PV largely due to the large order book. Further, CVs and 2-Wheelers are likely to maintain their positive growth momentum. In comparison, tractor volumes are likely to be muted on inventory de-stocking with dealers. Their top picks in the OEM space include Maruti Suzuki, M&M, Ashok Leyland, TVS Motor and Escorts.

Passenger VehiclesPV industry’s volumes should witness robust growth (30%+ YoY) on account of large order book and production ramp-up. Among OEMs, the domestic volumes are estimated to grow by 64% YoY for M&M, 51% for Tata Motors, and 18% for MarutiSuzuki. Vehicle discounts have reduced on MoM basis and remain significantly lower than the elevated levels seen in the past.

Commercial Vehicles

CV industry’s volumes should grow in double digits (15%+ YoY) with robust demand in both passenger and cargo segments. The e-way bill trend indicates better freight availability compared with last year. Emkay Global expects positive growth at 41% YoY for Ashok Leyland, 36% for Eicher Motor-Volvo EicherCommercial Vehicle, 13% for M&M, and 8% for Tata Motors in the domestic market. Ashok Leyland remains an outperformer due to favourable mix, new products, and aggressive marketing efforts.

Two-Wheelers

2-Wheeler industry volumes are expected to improve (10%+ YoY). Our channel checks indicate that urban demand is better than rural and scooters are doing well in comparison to motorcycles. The research house expects domestic volumes to improve by 41% YoY for EicherMotor-Royal Enfield, 12% for TVS Motor, 11% for Hero Moto Corp, and 10% for Bajaj Auto. Eicher Motor-Royal Enfield remains an outperformer on account of large pending order book for Hunter motorcycle.

Tractors

Tractor industry’s volumes are likely to marginally decline on account of inventory de-stocking with dealers. Emkay Global expect a decline of 2% YoY for M&M and flat performance for Escorts in domestic volumes.

Disclosures by Emkay Global Financial Services Limited (Research Entity) and its Research Analyst under SEBI (Research Analyst) Regulations, 2014 with reference to the subject company(s) covered in this report-: 1. EGFSL, its subsidiaries and/or other affiliates do not have a proprietary position in the securities recommended in this report as of November 24, 2022 2. EGFSL, and/or Research Analyst does not market make in equity securities of the issuer(s) or company(ies) mentioned in this Research Report Disclosure of previous investment recommendation produced: 3. EGFSL may have published other investment recommendations in respect of the same securities / instruments recommended in this research report during the preceding 12 months. Please contact the primary analyst listed in the first page of this report to view previous investment recommendations published by EGFSL in the preceding 12 months. 4. EGFSL , its subsidiaries and/or other affiliates and Research Analyst or his/her relative’s does not have any material conflict of interest in the securities recommended in this report as of November 24, 2022. 5. EGFSL, its subsidiaries and/or other affiliates and Research Analyst or his/her relative’s does not have actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the November 24, 2022 6. EGFSL, its subsidiaries and/or other affiliates and Research Analyst have not received any compensation in whatever form including compensation for investment banking or merchant banking or brokerage services or for products or services other than investment banking or merchant banking or brokerage services from securities recommended in this report (subject company) in the past 12 months. 7. EGFSL, its subsidiaries and/or other affiliates and/or and Research Analyst have not received any compensation or other benefits from securities recommended in this report (subject company) or third party in connection with the research report. 8. Securities recommended in this report (Subject Company) has not been client of EGFSL, its subsidiaries and/or other affiliates and/or and Research Analyst during twelve months preceding the November 24, 2022

Comments

Post a Comment